nanny tax calculator canada

As an employer you have responsibilities in the employment relationship. The amount of qualifying expenses increases from 3000 to 8000 for one qualifying person and from 6000 to 16000 for two.

Au Pair And Host Family Taxes Au Pair Money Saving Tips Tax Checklist

On your tax return you would pay household.

. You can claim up to 8000 for each. To determine if a treaty applies to you go to Status of. This is a sample calculation based on tax rates for common pay ranges and allowances.

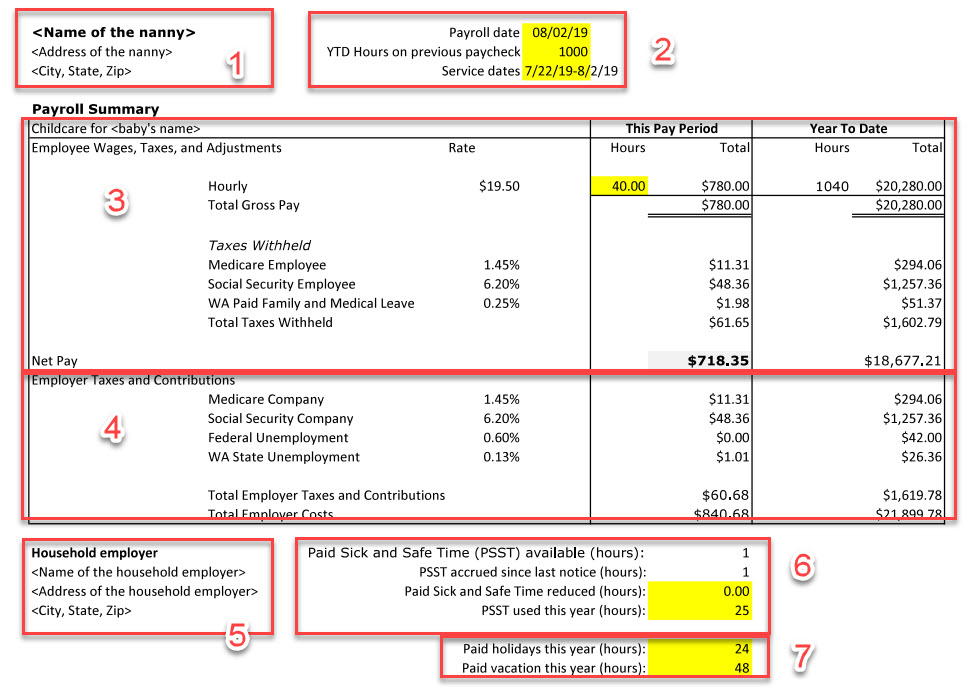

Then print the pay stub right from the calculator. NannyTax offers three domestic payroll tax plans giving you the flexibility to choose the package and price that best works for you. As you may know you can deduct child care expenses including a nanny against your eligible employment or self-employment income.

This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again. The Nanny Tax Company has moved. At the end of the year you would give the nanny a W-2 showing 100 of wages and 620 and 145 of medicare withholding.

As for Social Security and Medicare tax payment 765 will be shouldered by. Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. Our new address is 110R South.

This is any monetary amount you receive as salary wages commissions bonuses. This calculator assumes that you pay the nanny for the full year. Your individual results may vary and your results should not be viewed as a.

Good news though NannyPay offers a low-cost and up-to-date software solution for calculating nanny taxes and preparing annual Form W-2s and Schedule H up to 3 employees at no. If you require standard assistance our Starter package is. Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding.

Usage of the Payroll Calculator. Heres an example to highlight the differences between nanny take home pay employer out of pocket expense and the nannys hourly wage based on gross pay of 600week and net pay of. Gross vs Net Tax Calculator Employees Information Payment Frequency Weekly - 52 pay periods per year Bi-Weekly - 26 pay periods per year Semi-Monthly - 24 pay periods per year Monthly -.

This calculator allows you to get an idea of how much you will pay and how much your nanny will take home. For tax year 2021 the taxes you file in 2022. The rates of the online calculator apply only if you are a non-resident of Canada who is entitled to benefits under a treaty.

Canada income tax calculator. The calculator is updated with the tax. Employers need to withhold around 13-20 of their nannys gross wages to pay for the nanny tax.

The Canada Annual Tax Calculator is updated for the 202223 tax year. If you hire a caregiver baby-sitter or domestic worker you may be considered to be the employer of that person. Cost Calculator for Nanny Employers.

You can use the calculator to compare your salaries between 2017 and 2022. For these wages there would be payroll source withholdings of 3314 for income tax 1268 for Canada Pension Plan contributions and 484 for Employment Insurance. However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny.

Find out your federal taxes provincial taxes and your 2021 income tax refund. These rates are the default rates for employers in Pennsylvania in a locality that. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits.

The Nanny Tax Company has.

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

How To Do Payroll In Excel Youtube

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help

Provision For Income Tax Definition Formula Calculation Examples

40 000 After Tax Ie Breakdown May 2022 Incomeaftertax Com

Gross Pay Vs Net Pay What S The Difference And How To Calculate Both Wrapbook

Free Payroll Tax Paycheck Calculator Youtube

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Corporate Tax Meaning Calculation Examples Planning

Provision For Income Tax Definition Formula Calculation Examples

Tax Tips For Uber Lyft And Other Car Sharing Drivers Turbotax Tax Tips Videos

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Payroll Calculator Canada Apps On Google Play

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator