la county tax collector duplicate bill

Or call the Lake County Treasurers Office at 847-377-2323. Often when refinancing or selling property a loan or title company as well as the former mortgage company will pay the tax.

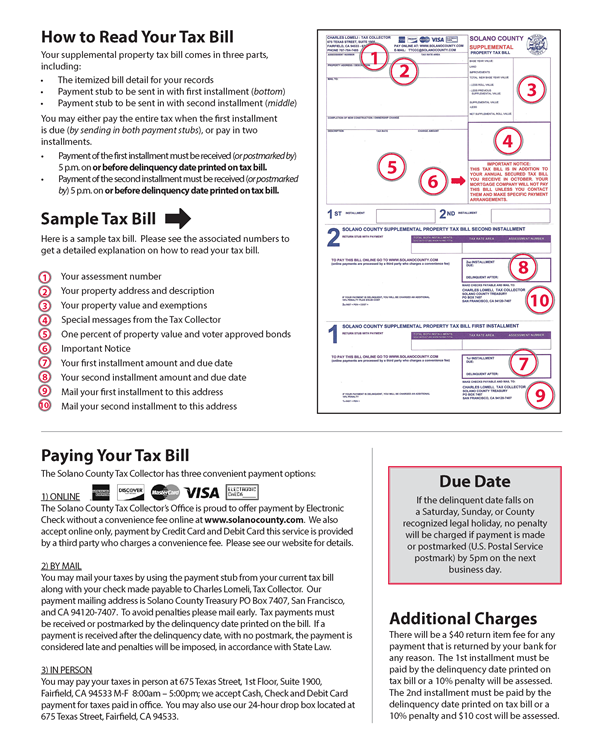

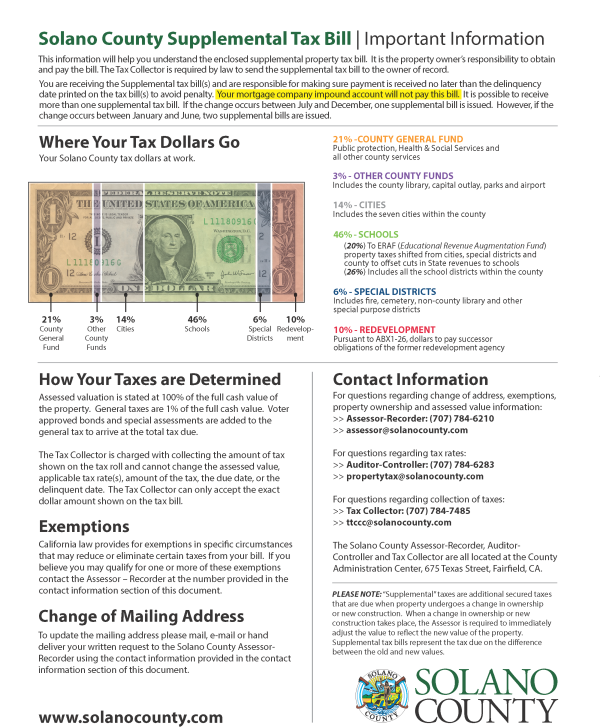

Solano County Supplemental Tax Bill

IMPORTANT MESSAGES Where My Taxes Go COUNTYWIDE 1 PROPERTY TAX DISTRIBUTION FY2020-21.

. Need the Personal Identification Number PIN which is printed on any original tax bill. View and pay your Los Angeles County Secured Property Tax Bill online using this service. The treasurer and tax collectors website provides current year unsecured tax amounts.

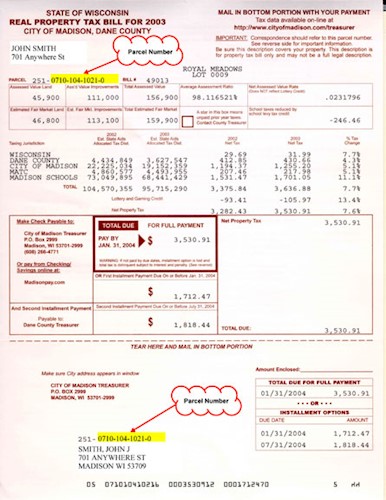

New Property Owner Information. Total Tax Due - This is the total amount due for the bill. Annual Secured Property Tax Bill The annual bill which includes the General Tax Levy Voted Indebtedness and Direct Assessments that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments.

The first installment is due November 1 and is delinquent December 10. 974 Call an agent Monday through Friday at 800am. The second installment is due February 1 and is delinquent April 10.

Contact Us Treasurer Physical Address. Auction Book for Delinquent Properties. The department also provides enforcement auditing consulting education estate administration and public information services.

I Want To Get A Copy Of. For a copy of the original Unsecured Property Tax Bill please email us at unsecuredpaymentsttclacountygov. Duplicate tax bills for homeowners available at no charge.

1099 Tax Form for Vendors. View and pay your los angeles county secured property tax bill online. Annual Secured Property Tax Bill The annual bill which includes the General Tax Levy Voted Indebtedness and Direct Assessments that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments.

Proposition 13 1978 limits the property tax rate to one percent of the propertys assessed value plus the rate necessary to. You can obtain a copy of the original Secured Property Tax Bill by emailing us at email protected lacounty. You can pay your bill using checking account or creditdebit card.

Property Tax Installment Plans. If there are any remaining unpaid property taxes and if you did not receive an Annual Secured Property Tax Bill from either the previous owner or the Treasurer and Tax Collector you may request a copy by calling the Treasurer and Tax Collectors automated Substitute Secured Property Tax Bill Request Line at 2138931103. The first installment is due November 1 and is delinquent December 10.

For a duplicate bill email us at infottclacountygov. Please put DUPLICATE TAX BILL in the subject heading of your email and include the Assessor ID No. The treasurers office is responsible for management distribution and receipt of public funds.

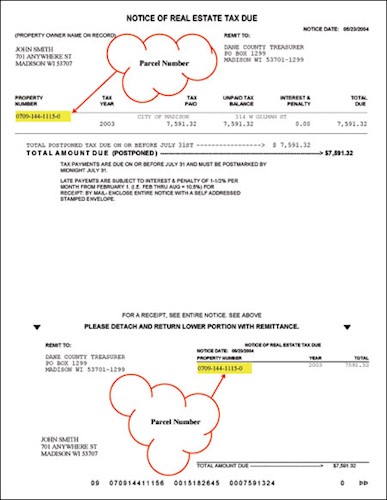

This website provides current year unsecured tax information and is available between march 1 and june 30 only. These supplemental bills are for the difference in value between. Duplicate payments occur when multiple tax payments have been made for the same property parcel number.

If the first installment is not received or United States Postal Service USPS postmarked by December 10 a penalty will apply. Property Tax Payment History. 807 You may write 2111 or 213.

The treasurers office is responsible for management distribution and receipt of public. 807 This number is 212 otherwise 211 or 213. You will need your Assessors Identification Number AIN to search and retrieve payment information.

The second installment is due February 1 and is delinquent April 10. The PIN cannot be provided by telephone e-mail or fax. The Treasurers Office will notify the assessee of record at the time the multiple payment was created.

Be sure to list the Roll Year and Bill Number and use the phrase Copy of Original Unsecured Bill in the subject line of the email. Adjusted Annual Secured Property Tax Bill. Obtain a copy of your bill online or contact the tax collectors office and we will send you a duplicate bill.

Interest attaches to late payments on the 1st of each month. The Annual Secured Property Tax Bill has two payment stubs. Frequently a new property owners regular tax bill is sent to the previous owner because the Tax Collectors Office is unaware the property has been sold.

Payments must be received prior to the end of the month to avoid an additional months interest. Online Property Tax Inquiry. Please include the AIN as you would in other text messages please list the phrase Duplicate Bill in your email or you can send us an email at 888.

If you do not receive the original bill by November 1 contact the County Tax Collector or Assessor for a duplicate bill. Assessor Auditor-Controller Treasurer and Tax Collector and Assessment Appeals Board have prepared this property tax information site to provide taxpayers with an overview and some specific detail about the property tax process in Los Angeles County. If the first installment is not received or United States Postal Service USPS postmarked by December 10 a 10 penalty will apply.

You will need to use a Personal Identification Number PIN which. The Annual Secured Property Tax Bill has two payment stubs. ALL LENDERS TITLE COMPANIES WITHOUT THE ORIGINAL TAX BILL MUST INCLUDE 5 FOR A DUPLICATE BILL FEE PER PARCEL.

If the second installment is not. PAYMENTS WILL NO LONGER BE PROCESSED WITHOUT THE 5 FEE. For a duplicate bill email us at infottclacountygov.

AIN in the body of the email. La Porte County Treasurer 555 Michigan Ave Ste 102 La Porte IN 46350 OR La Porte County Treasurer 302 West 8th Street Michigan City IN 46360 Payments accepted at any Horizon Bank branches during lobby hours located in Michigan City La Porte Coolspring-Johnson Rd Wanatah or Westville. Note the original bill may still have the prior owners name on it the first year.

Regardless of the reason if you do not receive a tax bill by November 10th print a copy online or contact this. Postmarks do not apply on other months of the year. La county tax collector duplicate bill.

You should also expect to receive either one or two separate supplemental bills which are in addition to your annual bill. La county tax collector duplicate bill. Please consult your tax bill for important notes regarding penalties fees and other ramifications of paying after the delinquent date.

Po box 99 durango co 81302 phone. How Do I Get A Copy Of My La County Property Tax Bill. You may also obtain a copy of this notice by calling the La Plata County Treasurers Office at 970-382-6352.

You will need to present your tax coupon along with your payment. Table of contents How Do I Get A Property Tax Statement In Ontario. We can only mail a copy of the.

How Do I Get A Copy Of My La County Property Tax Bill. Senior Citizen Property Tax Assistance. There is no charge for electronic check payments.

Adjusted Annual Secured Property Tax Bill. Via 711 711 7-11. How to Appeal My Tax Bill.

Tax Bill - Jim Spelich LaSalle County Treasurer.

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Secured Property Taxes Treasurer Tax Collector

Unsecured Prior Year Bill Los Angeles County Property Tax Portal

Pay Property Tax Online Dane County Treasurer Office

Substitute Secured Property Tax Bill Los Angeles County Property Tax Portal

Welcome To Montgomery County Texas

What S My Property S Tax Identification Number

Pay Property Tax Online Dane County Treasurer Office

Pay Online Chesterfield County Va

Adjusted Supplemental Property Tax Bill Los Angeles County Property Tax Portal

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Solano County Supplemental Tax Bill

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Pay Property Tax Bill Online County Of Los Angeles Papergov

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Copy Of A Property Tax Bill For La County Property Tax Tax Los Angeles Real Estate

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal